Final settlement in the salary system

When an employee is leaving the company, it’s essential to document this in the employment notice and disburse any accrued holiday pay. Here’s how to manage the final settlement using Conta.

When an employee is leaving the company, it’s essential to document this in the employment notice and disburse any accrued holiday pay. Here’s how to manage the final settlement using Conta.

You can use Conta’s payroll system to notify Altinn about an employee’s departure from the company. This is accomplished by entering the end date and salary details in the payroll system, followed by the a-melding.

The a-melding will communicate both the salary particulars and the termination of the employment relationship.

Here are the step-by-step instructions for final settlement in Conta:

1. Enter the end date and reason

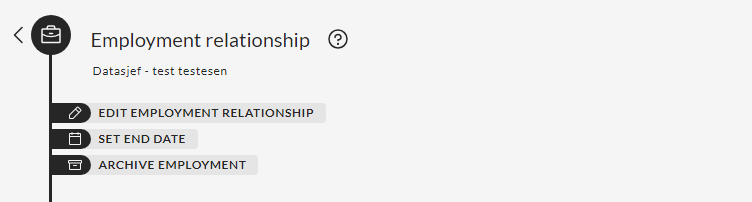

Select the employee, select the position and then click «Set end date». Here you get the opportunity to choose an end date (the last date the employee must work in the company) and the reason why they quit. Both of these are mandatory.

Some of the alternatives are, for example, that the employee has resigned themselves, that the employee has changed positions internally or that the temporary employment has expired.

Once you’ve selected the end date and reason, you can archive the position to prevent it from appearing in subsequent payroll runs.

OBS! Du kan ikke arkivere stillingen før du har kjørt siste lønning og betalt ut gjenværende feriepenger.

2. Run the final salary

The final ordinary salary is run as usual.

3. Process holiday pay

To ensure that all accrued holiday pay is accounted for in the final settlement, you must process these payments after the final payroll has been processed.

Initiate the process similarly to a regular payroll run, selecting the payment date and the earnings period start date as per your usual practice, depending on whether you pay in advance or in arrears. The standard earnings period is one month.

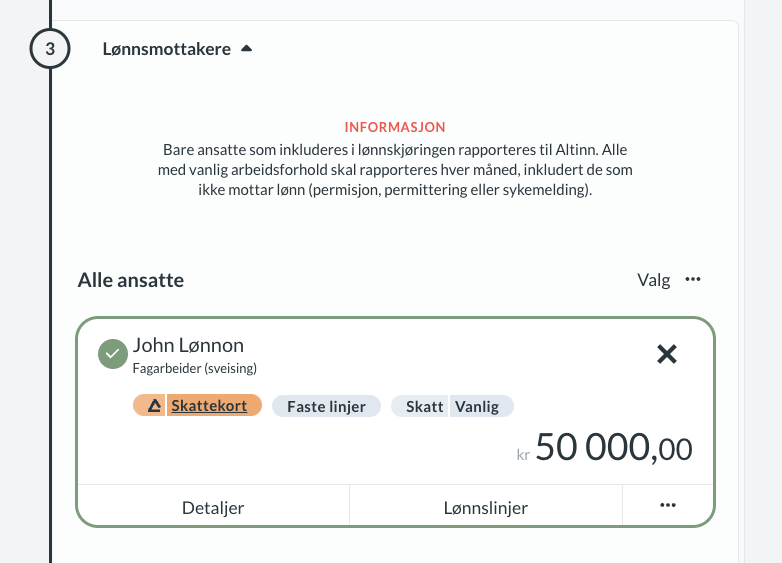

When you reach the wage earners section, you will encounter the «Add +» option.

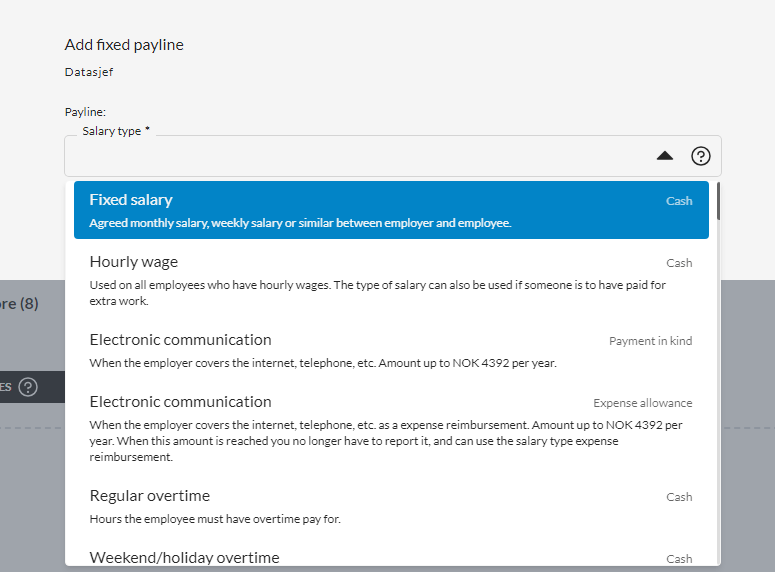

You will get several options:

- Holiday pay from the previous year: Accrued holiday pay from the previous year that hasn’t been disbursed yet.

- Holiday pay earned in the current year: Holiday pay that has been accumulated thus far in the current year and needs to be disbursed in the final settlement.

- Deduction from salary for holiday: Employed if the employee has taken holiday days that haven’t been accounted for in deductions.

When you select holiday pay from the previous year, any saved holiday pay will be displayed, provided that last year’s income is included in the payroll system.

You’ll need to manually calculate the holiday pay earned this year, using the information from the holiday pay report located under «Reports.» This report outlines the amounts reported via the a-message. It’s essential to process the final regular payroll before computing the earned holiday pay for the current year.

In the summary, you’ll notice that tax is deducted from the holiday pay earned this year, while no tax is deducted from the holiday pay accumulated from the previous year.

IMPORTANT: After processing the last regular payroll, make sure to remove the monthly salary from the payroll run. Only the holiday pay should be included in the final pay run.

Furthermore, you’ll need to settle the employer’s tax for all disbursed holiday pay. This aspect will also be included in the summary.

4. Send a-melding

Upon completion of the payroll run, proceed to send the notification as usual. Following this, you can distribute payslips and process the final settlement payments.

Ensure to archive the position to prevent its inclusion in the subsequent payroll run!