New product or service

Here is how to enter a new product or service in Conta.

Here is how to enter a new product or service in Conta.

When you create an invoice in Conta, you can immediately retrieve items from your item list in the item line field. This will save you a lot of time, especially if you send several invoices each month.

Enter a new product or service

You can enter a new item in two ways:

- By going to the menu tab INVOICE > PRODUCTS > NEW PRODUCT/SERVICE.

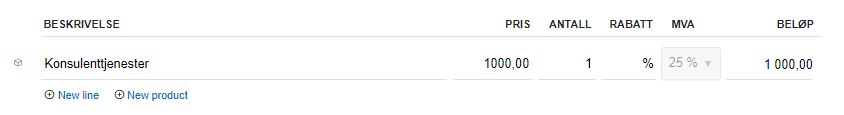

- By clicking on NEW LINE under the item line in the invoice.

If you see an icon of a box to the left of the item line, it means that it is associated with an item in the inventory.

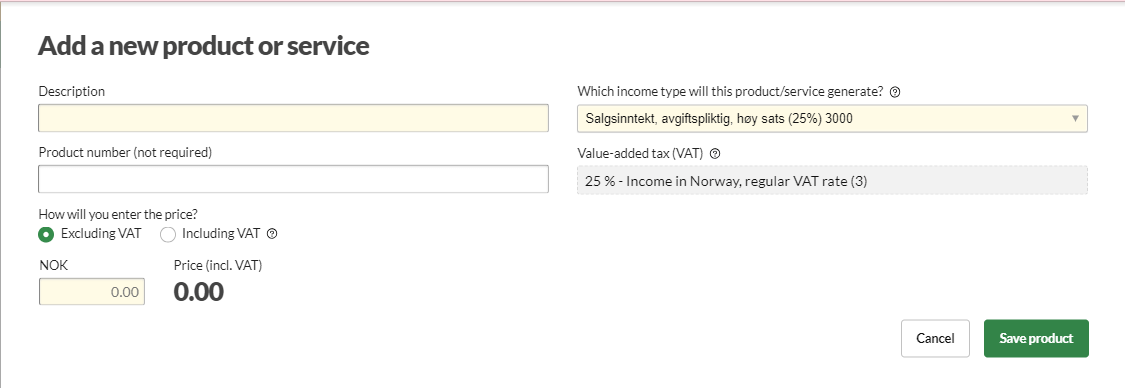

In the BESKRIVELSE field, you must fill in what the item is for. This text ends up in the item line field in the invoices you create.

Item numbers are not required, and Conta takes care of the requirements for item registers anyway. The input type «sales revenue» is the most common. This includes the vast majority of products and services that Norwegian companies sell. If you have questions about what to choose as income type, we recommend that you contact your accountant. If you do not have an accountant, we recommend that you contact one of Conta’s accounting partners.

What VAT rate should the product or service have?

25% VAT is the most common rate on most products and services, but there are exceptions. Sales of food and drink have 15% as the rate. Transport services have 8%.

TIP: You cannot register the company for VAT until it has passed a turnover of NOK 50,000 over 12 months. We still recommend adding VAT from the first invoice, and selecting EXCEPT VAT on the invoices until your company is registered. Then you don’t have to update the item list when the time comes.

Select EXC.VAT if you want the invoices to show the price excluding VAT. If you invoice private customers, you may want to have round prices, and then it is easier to let the system calculate VAT by selecting INCL.VAT.

In any case, the invoice will show the proportion of VAT in the item’s price, and include it in your reports.

It is a good idea to contact the Swedish Tax Agency or take a look in the VAT handbook to find out how much VAT must be added to the products and services you sell. Your invoices are important documents that form the basis for all reporting to the authorities, and it is smart to have everything clear before you start.

Do you need advice on pricing your services? Check out Conta’s hourly rate calculator!