Products (and services)

It helps to have something to sell if you're going to make money! Here you will find out everything about how to add, change and keep order for products and services in Conta.

It helps to have something to sell if you’re going to make money! Here you will find out everything about how to add, change and keep order for products and services in Conta.

By entering products and services, you make filling in the invoice much quicker, in addition to getting useful statistics.

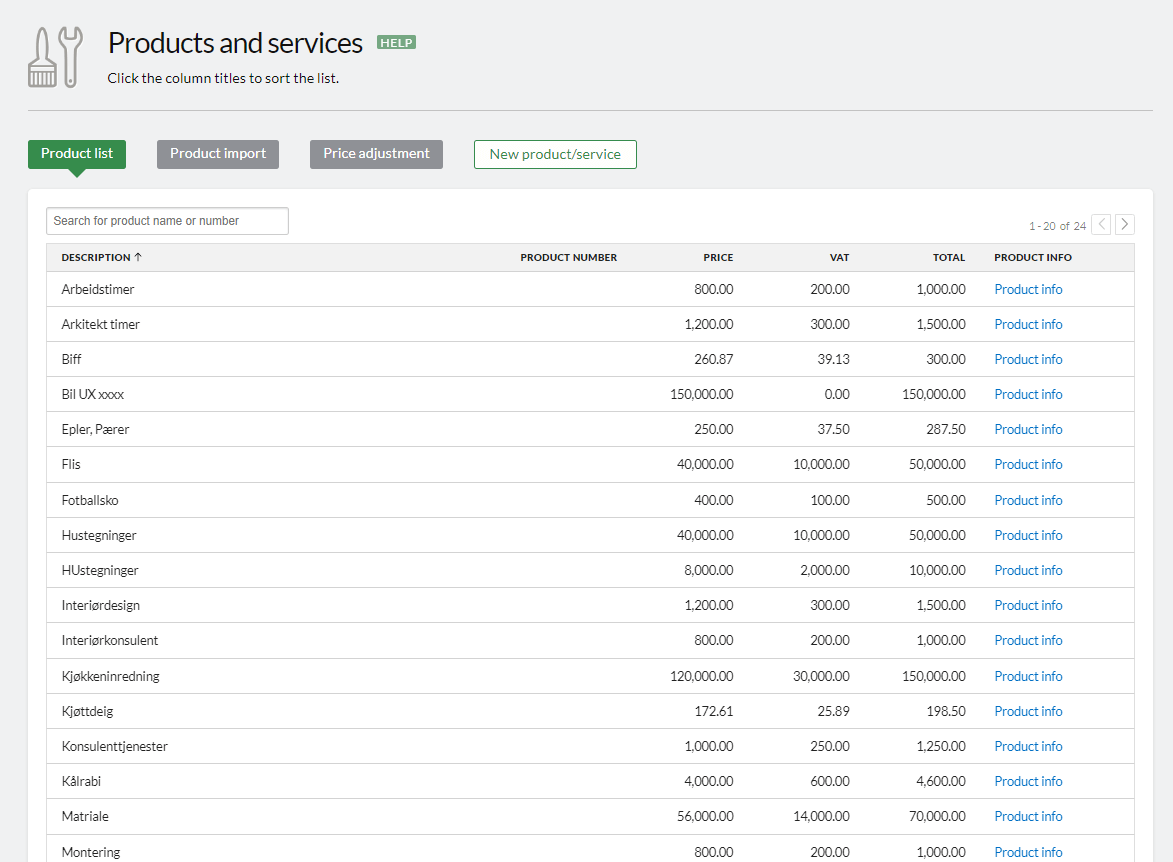

The item list is the first thing you see when you click on ITEMS in the top menu. Here you can also see the net price, VAT and the total price for each item or service you will invoice. Under the «product information» column on the far right, you can click on the products to see more detailed information, or make changes.

You can also download an overview of your products in CSV format by clicking DOWNLOAD CSV.

Product import

If you have used another system before Conta, it is smart to import the item list so that you save time and continue the statistics. It also makes it much easier to import old invoices if both customers and products have been imported. Under PRODUCT IMPORT, you can import products from spreadsheets, but also from another company you have access to in your account within the Conta services.

New product/service

Here is how you create a new product/service in Conta. We recommend that you enter products with VAT right from the start, even if you are not registered in the VAT register yet. You will then save time because you will not have to update the entire item list later.

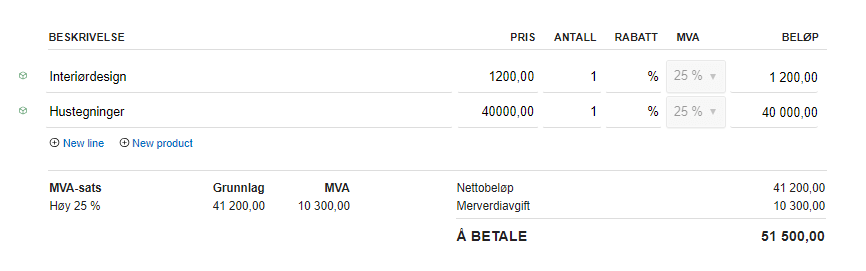

In order for statistics and reports to be correct when you add items to the item lines on an invoice, it is important that you search for an actual item from the item list and select it from the drop-down menu that appears. It is not enough to just write the name of the item. You can see if the product line is connected to the product by the fact that it has a small box next to it.

Price adjustment

You can adjust the prices of all your items at once.

This can be useful if you have many different items and want to adjust for consumer price index, inflation, or for other reasons.

Go to the tab called PRICE ADJUSTMENT. In the field, write the percentage value of the price adjustment. If you write a negative percentage value, the prices will be lowered accordingly.

Remember to choose whether you want to round to the nearest penny, crown or not round at all. You tick this off at the bottom of the page. Note that if you have chosen that the price of the item includes VAT, it is the price including VAT that will be adjusted. The opposite applies if the price of the item is recorded excluding VAT. Example: An item that is registered with the price 158,40 ex. VAT, when rounded to the nearest kroner, will be 174 ex. VAT after a 10% adjustment – which means that the price including VAT will be 217,50.

NB! You can’t undo these changes, so review before you finish.

Click ADJUST PRICES when you’re ready.