Connect to Altinn and collect your tax card

To ensure accurate tax calculation during payroll processing, it’s essential to obtain the tax card from Altinn. We provide guidance on how to establish a connection to Altinn and retrieve tax cards for Conta’s payroll system.

To ensure accurate tax calculation during payroll processing, it’s essential to obtain the tax card from Altinn. We provide guidance on how to establish a connection to Altinn and retrieve tax cards for Conta’s payroll system.

In order to send notifications and access tax cards, it’s necessary to link the payroll system to Altinn. This connection is established during the initial company setup. Additionally, you’ll need to connect to Altinn when retrieving the tax card.

Connect the payroll system and Altinn

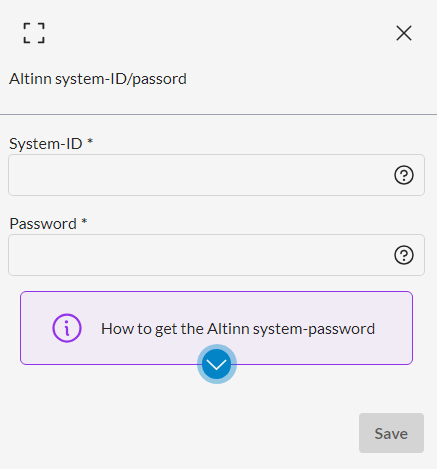

To establish a connection between Conta Lønn and Altinn, you’ll need to utilize your System ID and password when adding companies. If you don’t already have a System ID and password, you can create one within Altinn.

To set it up in Altinn, navigate to Private person > Profile > Personal settings > Altinn. Input your password. After clicking the Add button, your system ID will be generated and displayed.

When linking your company to Altinn within the Conta payroll system, you’ll use the System ID and password you created in Altinn. You can find this information on your profile page within the payroll system.

Collect tax card

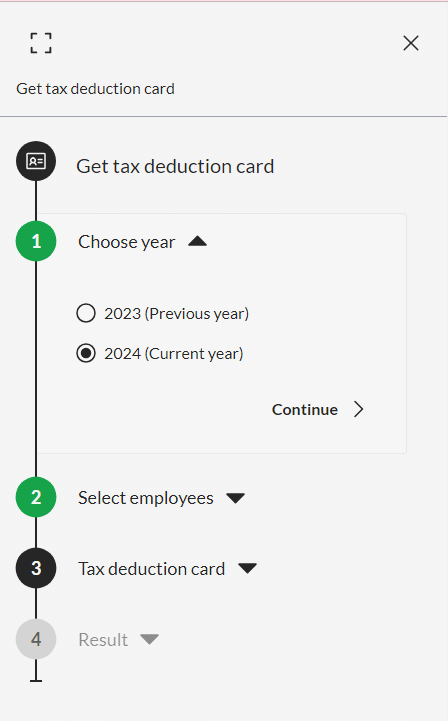

After you’ve entered the employee and position details, you can proceed to collect the tax card. Although you can obtain the tax card from Altinn at any time, it’s advisable to do so when registering the employee for optimal efficiency.

Note: You can process payroll without collecting a tax card, but in such cases, the employee will incur a 50 percent tax deduction.

To obtain a tax card, click on «Get tax deduction card.» This can be done by selecting the employee and then clicking «Send order.» Subsequently, you will be prompted to log into Altinn for tax card retrieval. Enter your own social security number along with the password you created in Altinn.

If you don’t have a password, you can create one in Altinn under Personal Profile > Advanced settings > Login information.

You have the option to collect tax cards for individual employees or for all employees collectively. When you submit your request, it sends a retrieval request to Altinn. The response will be directly sent back to the payroll system, and you won’t need to take any action in Altinn.

Once the tax card is in place, you can proceed with payroll, ensuring the correct tax deductions for the employees. In cases where an employee modifies their tax card after February, they will receive a percentage deduction for the remainder of the year, rather than a table deduction.

If an employee changes their tax card

If an employee within a company receives a new tax card, you’ll receive an email from Altinn indicating that an employee has obtained a new tax card. However, the email won’t specify which employee this pertains to.

Consequently, the employer must access the payroll system and retrieve the new tax card themselves. Since the employees must inform the employer about the new tax card, it’s common practice to collect tax cards for all employees to ensure accurate tax deductions for everyone. This process mirrors the initial tax card collection procedure.

You can find a detailed demonstration of how to process payroll in Conta’s payroll system in this video (In Norwegian):