How to add employees

To facilitate payroll management for your company through Conta, it’s crucial to initially enlist all employees in the payroll system.

To facilitate payroll management for your company through Conta, it’s crucial to initially enlist all employees in the payroll system.

In order to run payroll seamlessly in Conta, it’s essential to register all employees eligible for remuneration. You must provide employee details such as name, identification number (e.g., social security number), contact information, and bank account details for salary payments. Additionally, it’s imperative to input the employee’s job position information. Conta utilizes this data as a reference point during payroll processing and a-melding.

Moreover, you need to include the employees’ tax cards to enable automatic tax calculations. While you can add tax cards at any time, it’s advisable to do so concurrently with the employee registration process.

How to register employees

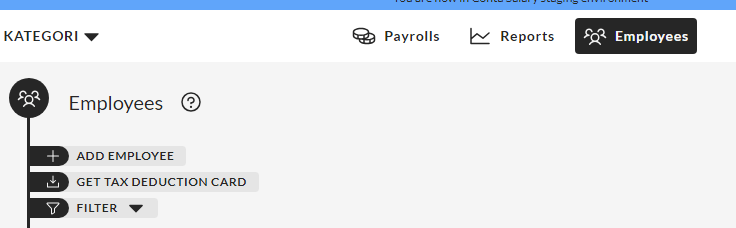

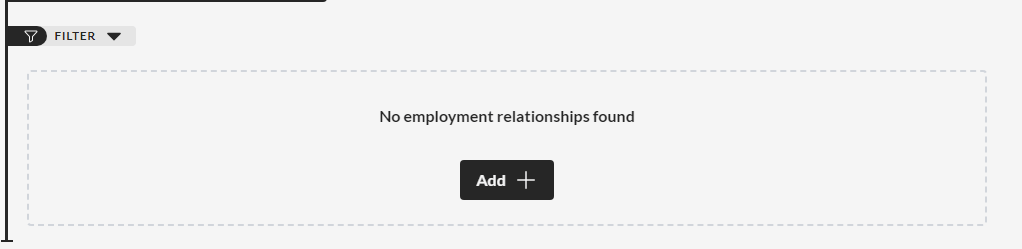

Navigate to the left-hand menu and select «Employees.» Prior to adding employees, the interface will display «No employees found.» To add an employee, click on «Add employee.»

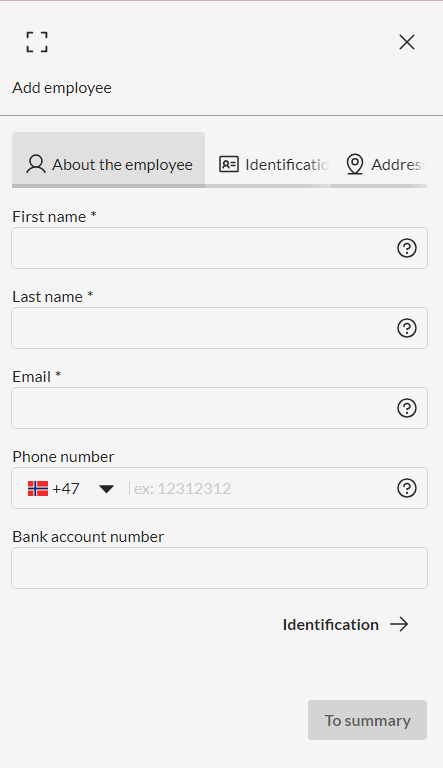

When registering an employee, you’ll need to provide their essential details, such as contact information, identification number, and the designated bank account for salary deposits.

Upon completing the employee’s information, it’s essential to include details about their position, including the job title, type of employment, employment percentage, and related specifics. This information serves as the foundation for generating pay slips and fulfilling reporting in the a-melding.

Once you’ve input all the necessary employee and position information, it’s crucial to obtain the employee’s tax card. This step enables you to calculate the salary using the appropriate tax percentage. It’s possible to calculate the salary without the tax card, but in such cases, a 50 percent tax deduction will be applied.

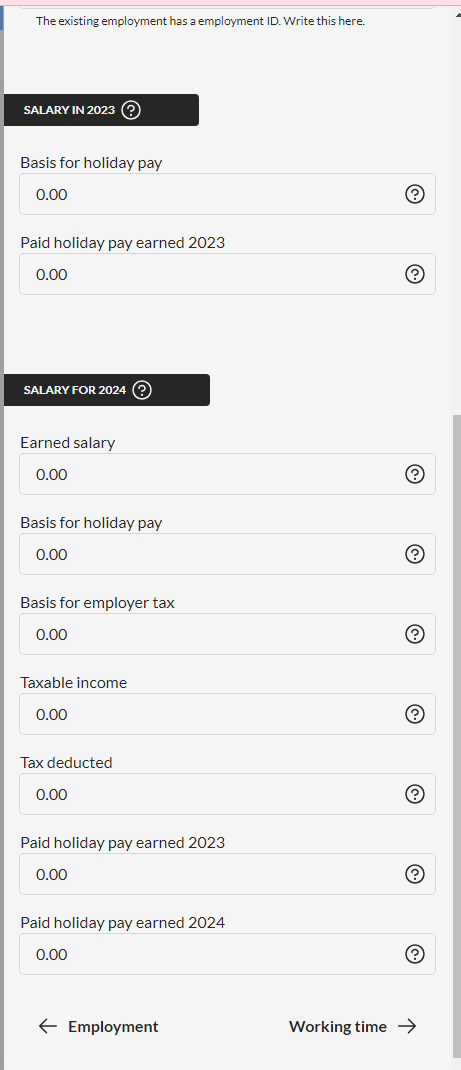

Information from the previous salary system

In instances where you transition to Conta from another payroll system, you’ll need to provide additional details about the employee. This may include their year-to-date earnings and the basis for holiday pay.

To accomplish this, navigate to EMPLOYEE > EMPLOYMENT RELATIONSHIP > ADD > PAST EMPLOYMENT and enter the relevant salary details from the previous system.