How to run salary

Each time employees are due to receive their wages, it’s necessary to process the payroll. Here’s a step-by-step guide on how to do it using Conta.

Each time employees are due to receive their wages, it’s necessary to process the payroll. Here’s a step-by-step guide on how to do it using Conta.

Running payroll with Conta is a straightforward process. Before initiating the payroll, ensure that the relevant employees are correctly set up in the payroll system with accurate position codes, work percentages, salaries, and related information. You can add this information prior to running payroll for the first time.

To run payroll, press PAYROLL RUN in the menu on the left, and then press CREATE NEW under PAYROLLS.

Follow these steps to complete the payroll run

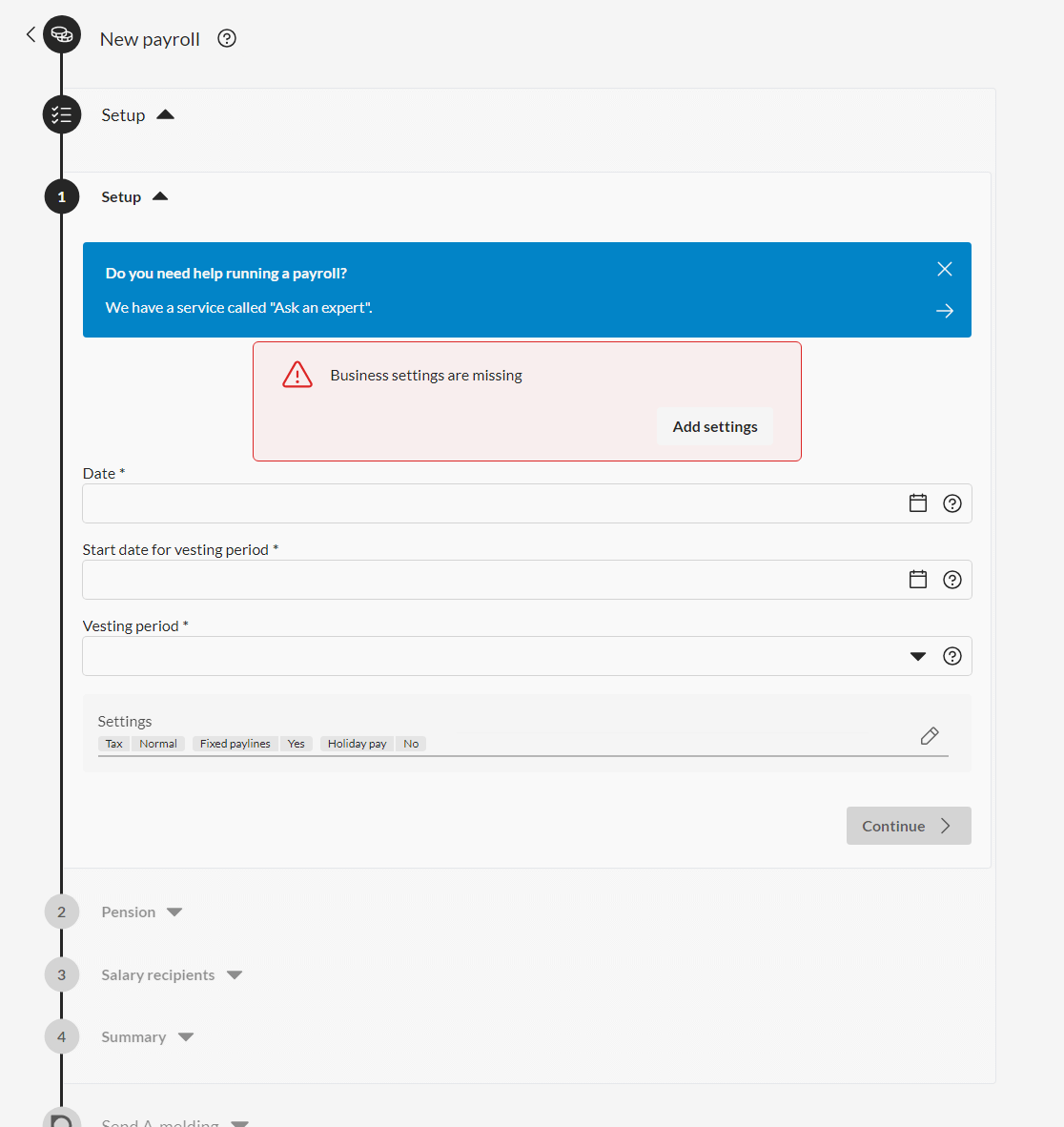

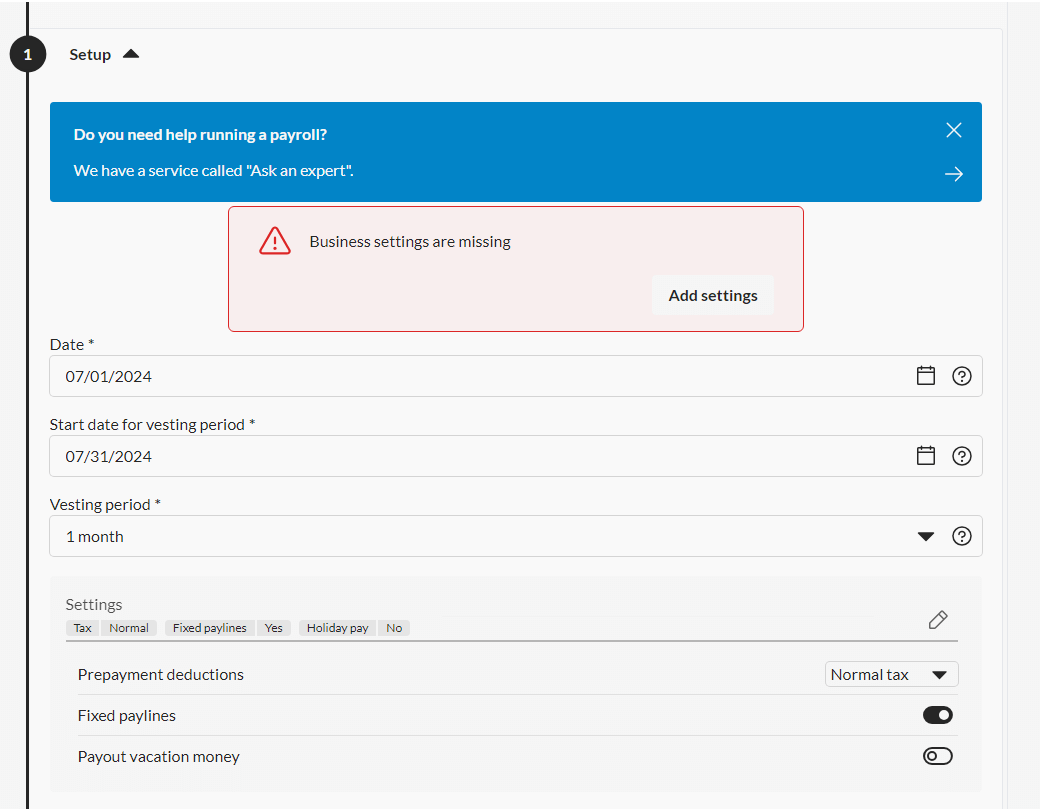

To begin, choose the relevant workplace and input the payment date, the starting date of the earning period, and its duration. Typically, the earning period spans a month, but you can opt for two weeks or one week as well.

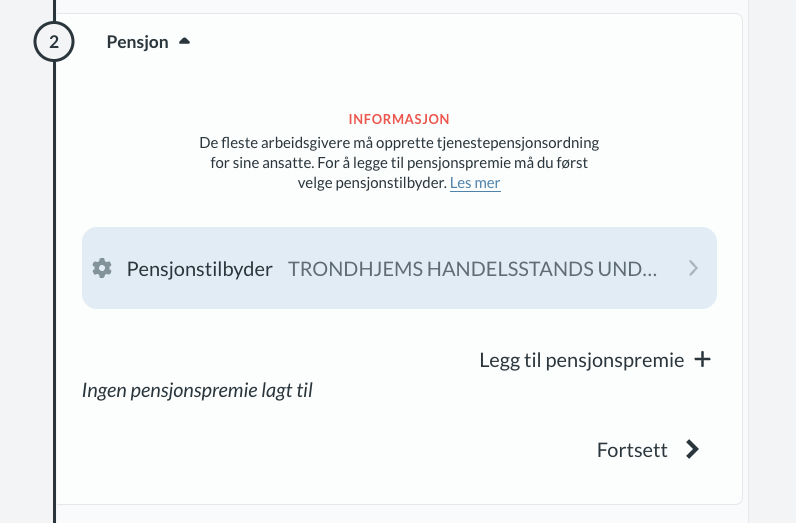

The next step is pension. The vast majority of companies are obliged to set up a pension scheme for their employees. This is called compulsory occupational pension (OTP). The pension must be reported with the salary every month, with the pension paid for that month. This is because employer’s tax must also be paid on the amount.

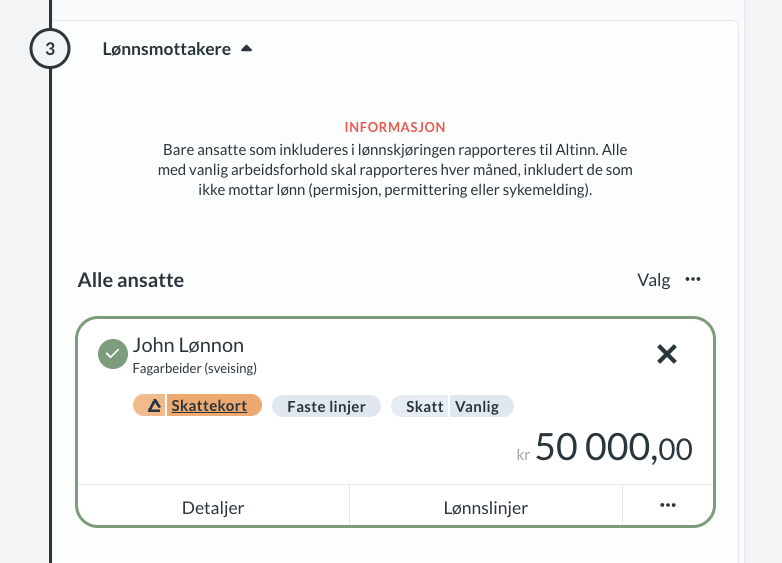

Next, you’ll include wage earners. This step involves selecting all individuals entitled to receive salaries during the specified period, with each payment determined by the details outlined in their job descriptions.

If you need to modify a salary, you can do so for each employee by adding supplementary salary lines. To achieve this, simply click on the salary amount. If the monthly salary hasn’t been entered as a fixed line for an employee, you can do so at this stage. Additionally, you have the option to incorporate more salary lines, such as bonuses, overtime, mileage allowances, and similar categories. Accessing your tax card involves linking the system to Altinn.

The next step is to submit the a-melding. It is submitted simultaneously with the payroll run and contains information on employees and their employment terms that require reporting.

Obs! Du må bruke samme system-ID når du henter tilbakemelding på Altinn som når du sender den inn. Du skal derfor ikke endre system-ID etter at du har sendt inn a-meldingen.

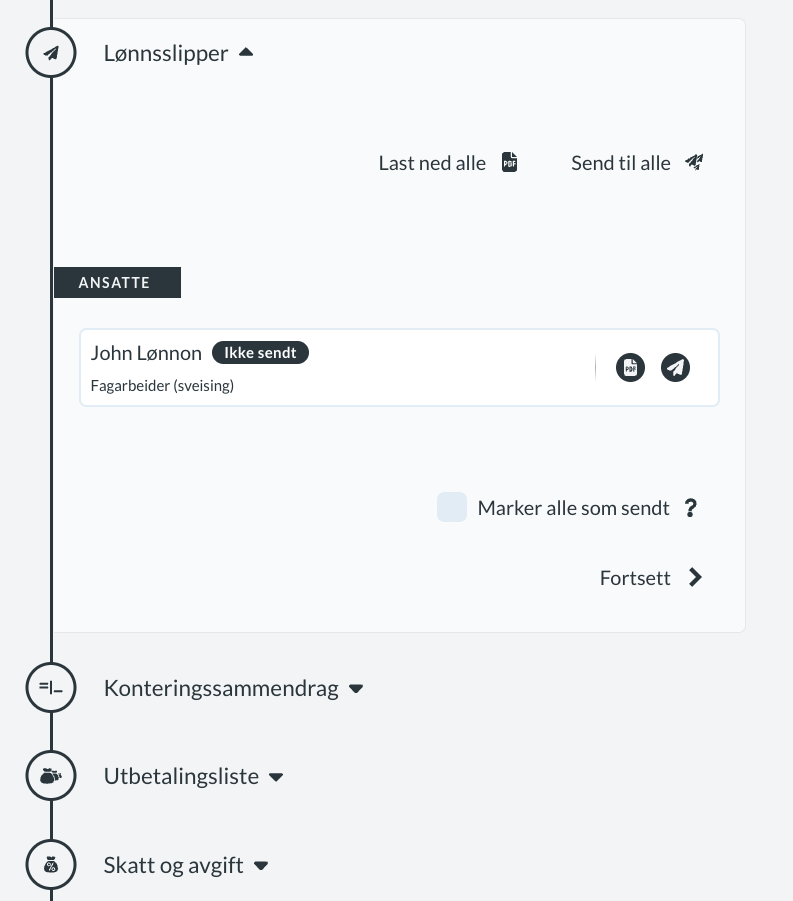

At the bottom you will find pay slips that can be sent out to the employees, a payment list of what is to be paid out, and what is to be paid in tax and employer’s contribution.

In addition, you will be told which accounts in the accounts for payroll, tax and employer’s contribution should be posted to. If you have connected the payroll system to the accounts, you can post directly to Conta with a few clicks.