Credit notes

Credit notes are the way you fix errors in invoices. If you have created an invoice that contains errors, you must create a credit memo that «zeroes out» the existing invoice and then create a new one.

Credit notes are the way you fix errors in invoices. If you have created an invoice that contains errors, you must create a credit memo that «zeroes out» the existing invoice and then create a new one.

Bokføringsloven § 10 states that it is not permitted to change invoices after they have been created. To change or «delete» an invoice, you must create a credit note that «zeroes out» the original invoice.

Examples of using a credit memo could be that you made a simple typing error, or that you invoiced the wrong amount to the customer. But really, there can be all kinds of mistakes.

This video explains what a credit note is and how you credit an invoice in Conta:

How to do it

- Go to your invoice list.

- Find the invoice you want to credit in the list by clicking on DETAILS in the row of the invoice in question.

- In the invoice details, press the CREATE CREDIT NOTE button on the right of the page.

A dialog window will appear allowing you to date the credit memo. Today’s date is the default. The date of crediting is important for VAT and tax.

Send credit note

If your customer has already been sent the invoice you want to credit, you must also send the credit memo. It is required by law that the customer has this in their accounts. But if you haven’t sent out the invoice yet, the customer doesn’t need to know that you made a mistake. Then just send the new invoice you create.

When you send the credit note, you have the same choice as for invoices otherwise:

- As email

- As EHF (requires Conta credit in Intro and Standard)

- In the mail, either by clicking POST WITH CONTA or PRINT YOURSELF

The most natural thing is to send the credit note in the same way as you sent the original invoice.

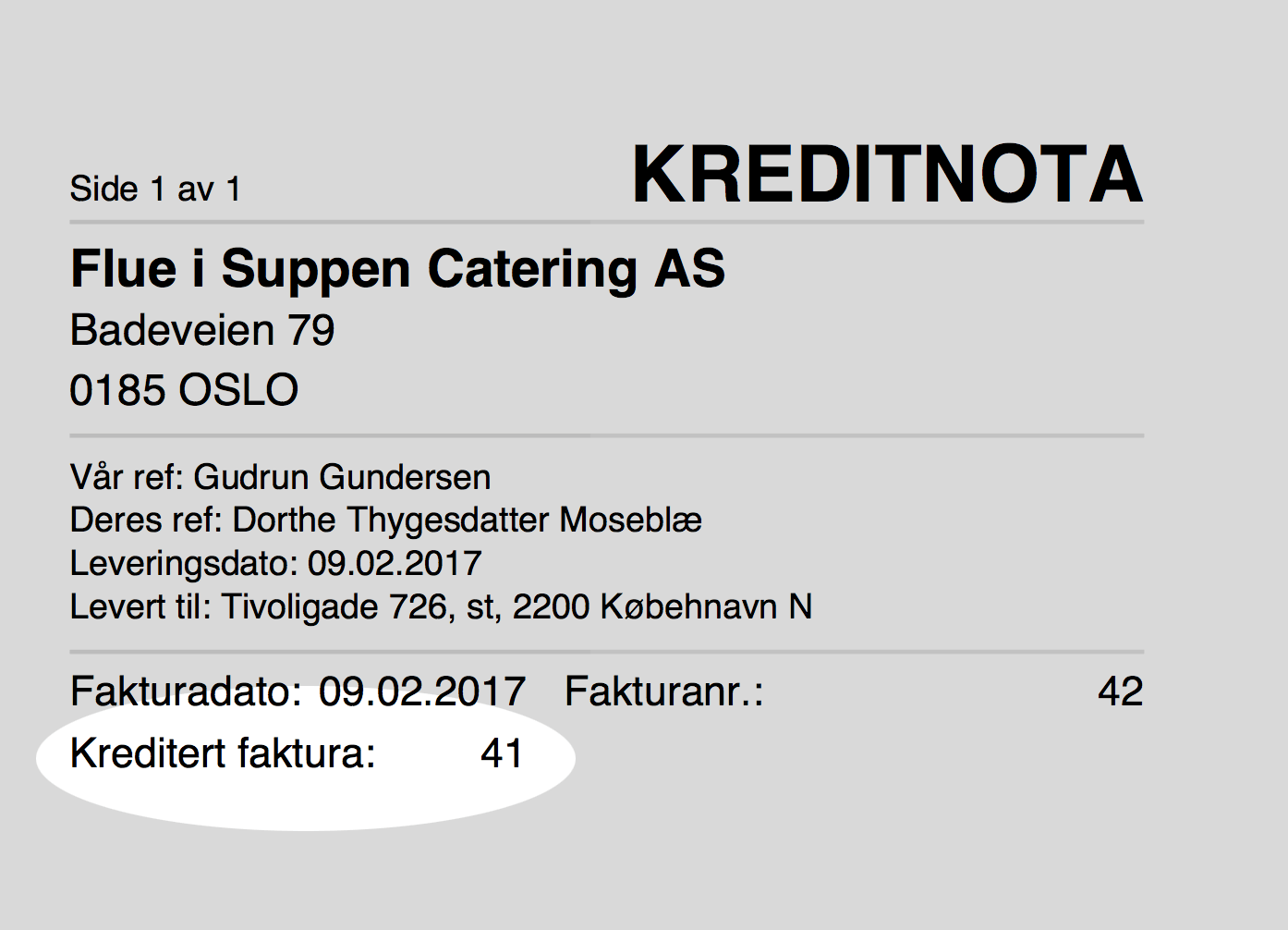

The credit note document itself contains a reference to the original invoice number so that it becomes clear which invoice has been credited. Red text at the bottom of the credit note also makes it clear that this is not an invoice to be paid.

In the upper part of the credit note, «Invoice number» and «Invoice date» will be written. This is not an error. The system considers credit notes as part of the invoice number series.

The credit note appears in the invoice list as a negative amount (with a minus in front) when you have sent it.

The total turnover for the credited invoice is now zeroed out. The reports will still show the income from the credited invoice if the crediting is done in another month, or a new year. In the month you created the credit note, turnover will be correspondingly lower.

The result will therefore be zero in total. Remember that the business must tax and pay VAT for turnover in a financial year that is not credited until the following year.

Credit parts of an invoice

To make the bookkeeping for the companies out there as simple as possible, Conta only has the option of crediting entire invoices and not partial amounts. Read more about why you can only credit entire invoices.